Marketers proceed to maneuver money into digital video despite significant doubts about audience measurement, in line with a recent report from the IAB.

Digital video ad spending is anticipated to be greater than $62 billion this year, the IAB predicts. That is a 16% increase over last year and greater than twice the $26 billion in 2020.

Since that year ad spend share shifted nearly 20 percentage points from linear TV to digital video. In 2024, digital video will get 52% of the video ad dollars, surpassing linear TV for the primary time. This is a mirrored image of viewers’ shift toward digital. For example, the most important pay TV providers lost 6% of their subscribers within the last two years: 5 million in 2023 and 4.6 million in 2022.

Free ad-supported streaming TV ad spend increased to 51% from 44% last year. It is now according to ads bought on virtual multichannel video programming distributors (55%) and streaming platforms (53%).

Measurement problems persist

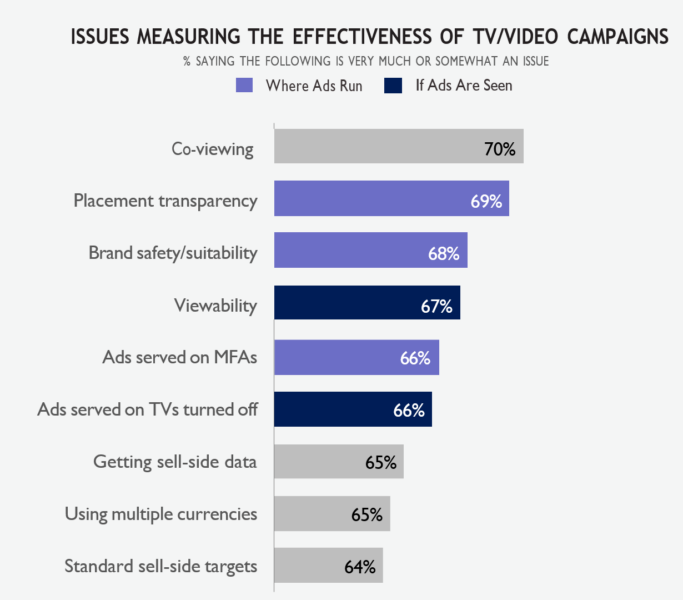

Measurement issues remain an overall problem but vary significantly by channel — particularly with online video and CTV. Inconsistent publisher-level measurement frameworks plague online video. This makes it hard for buyers to grasp placement, viewability and guarantees. CTV faces similar issues as a consequence of an absence of shared show-level data and inconsistent measurement approaches.

This and the proliferation of privacy-by-design have buyers turning to measurement tools less reliant on data signals. AI, data-driven optimization, MTA and MMM enable buyers to grasp performance based on modeled data as signal deprecation decreases the pool of obtainable data.

Dig deeper: How to measure the impact of name marketing

Nine out of ten advertisers are using some form of other audience measurement — either via transacting, testing, or having discussions with vendors. More than 75% of buyers requested that sellers provide greater transparency, offer performance-based solutions, grant access to first-party data and/or help set recent measurement standards.

Why we care. Digital video will proceed to be a go-to channel for advertisers looking to achieve engaged audiences at scale for the foreseeable future. Its popularity is driven by the variety of alternative ways consumers can get content variety formats. That’s why there’s a lot growth across short-form, long-form, creator-drive and immersive content formats. While this means more work for marketers, it also lets them serve multiple consumer demos, mindsets and interests.

Methodology

The data is from a 15-minute anonymous online survey, taken by 364 people. All respondents:

- Are involved in recommending, specifying, or approving promoting spending in digital video

- Spent a minimum of $1 million on promoting in 2023

- Work at agencies or directly for a brand marketer

The survey was conducted between February 15 and March 1 of this year. The full report could be downloaded here.

The post Digital video ad spend sees 16% increase this year appeared first on MarTech.

Read the total article here