When you speak of the international finance world, HSBC is a towering giant, its name a shorthand for financial marketing tactics with a presence in greater than 65 countries. But underneath this front of success lies a charming tale of adaptability plus innovation.

With US$3.091 trillion in total assets as of June 2023, HSBC stays Europe’s largest bank; it holds a staggering $14.3 trillion in assets under custody (AUC) and $5.7 trillion in assets under administration (AUA) in 2023, demonstrating its immense financial clout.

And, how has that financial services holding company based within the United Kingdom, established itself as a pacesetter in financial services?

So, keep reading and embark on a journey into the HSBC marketing galaxy.

Overview of HSBC’s Marketing Approach

The financial services giant operates a multifaceted marketing strategy surrounding the 4Ps of promoting – product, price, place, and promotion. This strategic approach has enabled HSBC to establish a formidable global presence and cater to the assorted needs of its customers, including private banking, wealth management and retail banking, investment banking & global banking, and business banking.

When it comes to pricing decisions, HSBC combines aspects equivalent to customer loyalty, product usage, and risk management into its pricing strategy. This subtle approach allows the bank to tailor its pricing strategies to specific customer segments and market conditions, maximizing each customer satisfaction & profitability.

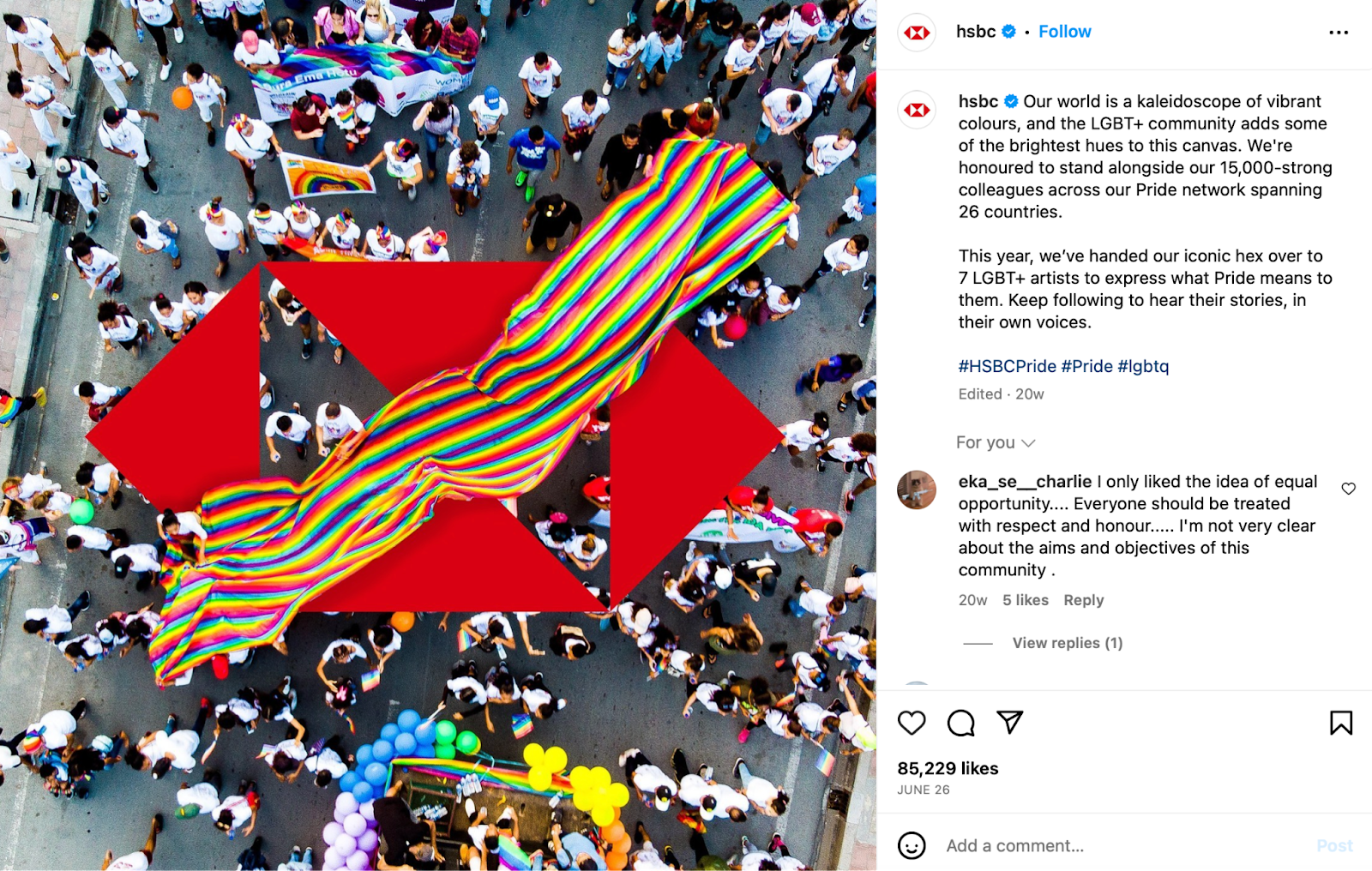

What’s more, the bank’s promotional activities deal with brand awareness, customer engagement, and digital marketing campaigns – as well as to traditional methods and sponsorships.

What’s more, the bank’s promotional activities deal with brand awareness, customer engagement, and digital marketing campaigns – as well as to traditional methods and sponsorships. Additionally, its marketing strategy is firmly rooted in customer satisfaction and long-term relationships, tailoring its product offerings, and promotional activities accordingly. This customer-centric approach has enabled HSBC to have a market capitalization of roughly 116.6 billion euros.

The Evolution of HSBC Marketing Strategy

Our ambition is to be the popular international financial partner for our clients.

Noel Quinn, Group Chief Executive

To unlock the secrets of HSBC’s marketing approach, we must embark on a tour through time, immersing ourselves within the revolutionary era that redefines its reference to its global goal.

The marketing strategy of The World’s Local Bank has undergone an exceptional transformation, reflecting the needs of its audience and the complete financial terrain. In its productive years, HSBC relied on conventional/traditional marketing channels, like print and TV ads, to reach its audience. However, as the web and social media emerged because the prior communication tools, HSBC shifted its focus toward digital marketing, evolving as an adopter of this revolutionary approach.

The bank’s earlier adoption of social media proved to be a stroke of promoting genius. By showing a powerful presence on popular platforms like Facebook, Twitter, and Instagram, the bank humanized its brand, crafting a direct line of communication with its goal. In other words, HSBC did what it needed to do on social media as a fintech company.

As we will see in the identical manner in PayPal’s marketing strategy, through engaging content, interactive campaigns, and personalized interactions, HSBC cultivated a way of community.

Through the years, HSBC has turn out to be certainly one of the pioneers of mobile banking by crafting UX-powered platforms & apps that seamlessly integrate with its digital marketing efforts. This approach delivered customers convenience, allowing them to access their funds anytime, anywhere. For instance, the HSBC mobile app quickly evolved right into a universal tool, further setting its position on the forefront of digital banking.

HSBC’s Branding and Positioning within the Global Market

Time to explore the brand’s core values.

At the center of HSBC’s brand lies a dedication to supporting its customers to reach their economic objectives. The bank’s brand essence is encapsulated in its tagline, The World’s Local Bank, reflecting its ability to deliver global reach while maintaining a deep understanding of local markets & needs.

Noteworthy efforts include global marketing campaigns, strategic sponsorship programs with entities like Formula One and The Rugby World Cup, and a strong digital presence, all contributing to brand visibility & customer engagement. In the international market, HSBC’s brand is characterised by dependability and expertise with local insights and a dedication to innovation and customer-centricity.

Source: https://www.hsbc.com/

HSBC’s efforts regarding tech & innovation not only reflect a dedication to staying on the forefront of the financial industry and set the bank as a contemporary plus accessible banking solution. So much in order that, the well-known bank is working a dynamic & inclusive work culture, encouraging its employees to deal with skill development for the long run.

That approach, after all, strengthens the interior capabilities while enhancing the brand’s image as a forward-thinking institution that invests in the expansion and well-being of its people worldwide.

What’s more, HSBC’s dedication to sustainability is supported by its financial performance, with total assets reaching US$3.091 trillion as of June 2023 and a customer base of roughly 45 million worldwide. The brand’s valuation at US$12.7 billion not only highlights its financial prowess but additionally solidifies its position as certainly one of the most respected financial brands globally.

Key Components of HSBC’s Marketing Strategy

As mentioned, HSBC’s marketing strategy revolves around designating a strong brand identity, segmenting its customer base, using various digital marketing channels, and making data-driven decisions.

We also know that the worldwide bank invests in promoting campaigns and marketing efforts that showcase its global reach, financial expertise, and unwavering commitment to customer support. More specifically? Keep reading.

Customer-Centric Approaches in HSBC’s Strategy

We are equally committed to ensuring there aren’t any unnecessary barriers to finance for our customers. We aim to create a welcoming, inclusive, and accessible banking experience.

HSBC Holdings Annual Report and Accounts 2022

As users already know and experience, the marketing strategy of HSBC Bank is deeply rooted in customer-centricity. So much in order that the marketing team of the finance institution places the needs of its customers & prospects at the center of each decision.

Understanding the audience and its financial objectives, HSBC segments its customer base. While doing so, the bank analyzes customers’ behavior patterns and tailors its marketing strategy accordingly – offerings, service interactions, messages, etc. And that form of customer-centered marketing approach brings a way of connection and trust.

Relatedly, the bank is understood for prioritizing customer engagement & experience; by encouraging ongoing interactions beyond standard banking operations. The bank actively reaches customers (and prospects) via various channels – website, mobile app, social media platforms, and in-person interactions. Here is a related statement:

For our customers and colleagues, we improved the accessibility of our public web sites, mobile applications, and internal systems. AbilityNet, the digital accessibility charity, benchmarked HSBC as having probably the most accessible website compared with other local competitor banks in 10 of 13 of our key Wealth and Personal Banking markets.

HSBC Holdings Annual Report and Accounts 2022

That approach helps the HSBC customer help team to assemble feedback, address concerns promptly, and supply timely updates on relevant financial matters.

It can also be known that the bank is transforming its entire digital systems, each external and internal, to be accessible. According to the bank’s annual report, HSBC engaged over 2K colleagues in digital accessibility awareness, sponsored by the takeoff of a “digital accessibility hub.” The hub acquired the very best digital accessibility award on the previous 12 months’s Digital Impact Awards.

Product and Service Innovation at HSBC

Another key element supporting HSBC’s marketing strategy involves the continual development of recent services tailored to meet the needs of its customers. In recent years, the bank has made remarkable progress in various areas.

As certainly one of them, the bank has dedicated noteworthy resources to improve its digital banking platforms, offering customers a seamless way to manage their funds.

Source: https://www.hsbc.com/

HSBC offers various investment options & solutions to help its customers meet their long-term financial needs & objectives. The bank’s investment advisors provide personalized advice and guidance to help customers make informed investment decisions.

Digital Transformation in HSBC’s Marketing

It’s a general fact now that financial institutions should stay ahead of the curve by embracing digital transformation with open arms; like HSBC does. With an annual ICT spending of $10.5 billion in 2022, the worldwide finance powerhouse is showcasing its commitment to revolutionizing the banking landscape. From acquiring cutting-edge software to partnering with top-tier ICT service providers and finance marketing agencies, HSBC is leaving no stone unturned in its quest to deliver a seamless and personalized banking experience for its customers across the globe.

Leveraging Technology for Enhanced Customer Experience

As we develop our content strategy, we will assess our customers’ need for certain information by promoting key articles, research, or topics, and seeing what form of response we get. This form of insight is invaluable in our mission to turn out to be more customer-centric.

Amanda Rendle Global Head of Marketing, Commercial Banking, and Global Banking and Markets

As mentioned above, HSBC, became certainly one of the pioneers of digital banking; in previous years, the bank launched its digital-only bank, a standalone platform that gives a seamless and convenient banking experience.

The move which goals to cater to the evolving needs of tech-savvy customers, eliminated the necessity for physical interactions in money transferring, account opening, and more. In addition to offering a convenient banking experience to customers, that form of banking option allowed users to access their accounts through all digital platforms.

Simultaneously, the bank began investing in enhancing its mobile app inside its marketing strategy, with its improved safety features & user-friendly interface which allows customers to manage their entire funds on the go – account management, bill payments, money transfers, and custom financial insights.

At that time, we also need to mention the bank’s data-driven approach. As an enormous a part of HSBC’s digital marketing strategy, data analytics, and artificial intelligence has been used for a remarkable time to gain deeper insights into customer behavior, preferences, and financial needs. These insights enable the finance giant to customize its offerings and services to each customer.

Finally, financial cooperation actively explores the potential of blockchain and distributed ledger technology (DLT) to improve its operational processes while offering full transparency. In that way, HSBC executes supply chain operations and complies with regulations.

HSBC’s Global Marketing Strategy

From now on, we’ve highlighted that HSBC’s global marketing strategy is a dynamic approach that reflects the bank’s commitment to comprehending its diverse customer base across the globe. But how can they try this? Start exploring.

Adapting to Diverse Markets: HSBC’s Regional Strategies

HSBC’s success (each digital and corporational) stems, partially, from its knack for tailoring strategies to the unique characteristics of the markets it serves. The bank acknowledges that every region shows its mix of economic, cultural, and regulatory aspects, necessitating a slight approach to marketing and business strategies.

For instance, in Asia (China, India, and Southeast Asia), the bank has customized its offerings to align with the features of the Asian market; like providing Shariah-compliant products in Muslim-majority countries within the region. What’s more, in that region, the bank offers products like UnionPay debit/bank cards while supporting economic growth via products like microfinance loans.

Similarly, within the United Kingdom, France, Spain, and other European countries, HSBC delivers specialized solutions equivalent to wealth management. As for the United States, Canada, and Mexico, the bank offers a various range of retail banking services by specializing in local preferences.

To get insights about local preferences, the bank uses HSBC Global Network, boasting over 6K branches in greater than 70 countries, which stands out as a component.

Building a Global Brand: Lessons from HSBC

Lesson #1 – “The World’s Local Bank” Positioning: HSBC emphasizes its capability to provide each global reach and native expertise, placing itself as a long-time & trusted partner for patrons guiding the world of finance.

Lesson #2 – Building Sponsorship & Partnerships: The banking corporation strategically associates with organizations and events that align with its brand values plus target market preferences, raising brand awareness and gaining visibility.

Lesson #3 – Local Insights and Cultural Sensitivity: As key players within the marketing mixture of HSBC, local understanding and cultural sensitivity make sure the bank’s marketing campaigns are relevant, respectful, and effective in diverse markets.

Lesson #4 – Multi-channel Marketing Approach: By utilizing its international network and understanding, the finance corporation operates a multi-channel marketing approach, using a combination of traditional and digital channels to reach its goal.

Lesson #5 – Bold Brand Identity and Messaging: Through its global marketing efforts, HSBC has successfully established a cohesive brand image with consistent messaging and a recognizable brand identity.

Analyzing the Success of HSBC’s Marketing Strategies

HSBC can also be known for its track record of creativity in its digital marketing efforts. Let’s take a have a look at a number of the campaigns.

Case Studies: HSBC’s Most Successful Campaigns

The Home To So Much More

The campaign created by well-known Wunderman Thompson refers to HSBC UK’s brand values, emphasizing openness and connection just after Brexit. The campaign with the tagline “We aren’t an island. We’re home to so way more,” delves into the concept of home and its true significance.

Source: https://www.wundermanthompson.com/work/home-to-so-much-more

The World’s Local Bank

The campaign achieved notable success by highlighting the corporate’s capability to offer a mix of world reach and native expertise, striking a chord with customers in markets globally. The campaign effectively utilized a variety of digital channels, equivalent to social media, video content, and targeted promoting, to communicate that HSBC comprehends and addresses the distinct needs of its customers in diverse regions.

Borders

Another HSBC X Wunderman Thompson collaboration, “Borders” focuses on breaking down barriers and fostering global connections. In addition to highlighting the importance of human interaction and the bank’s role in it, the emotional digital marketing campaign showcases HSBC’s commitment to understanding and serving its global customer base.

Outline

HSBC’s digital marketing campaigns are highly targeted and tailored to meet the unique needs of its diverse customer base from throughout the globe. In its digital marketing efforts, the finance giant uses customer data analytics to segment audiences, personalize messaging, and optimize campaign performance, ensuring maximum impact.

HSBC’s ability to connect with its global customer base in a meaningful way is clear in its modern tactics, data-driven insights, and commitment to understanding local needs. As a result, HSBC is a pacesetter within the digital marketing sphere.

Read the total article here