“Sociable” is the newest commentary on vital social media developments and trends from industry expert Andrew Hutchinson of Social Media Today.

Snapchat has published its Q2 23 performance report, which shows a rise in overall users, especially in developing markets, in addition to signs of recovery for Snap’s ad business, which now has more ad partners than ever, who’re seeing improved optimization performance.

First off, on users, Snapchat added 14 million more each day active users (DAU) in Q2, taking it to 397 million DAU overall.

The majority of that growth continues to be coming from the ‘Rest of the World’ category, with Snap only adding one million more users in each North America and EU respectively. Snap added 12 million more users outside of its most important markets, with the app continuing to see solid take-up in India, where mobile adoption and improving connectivity has opened up recent opportunities for the app to reach this audience

Indeed, over the past 12 months, Snap has added 40 million more users in the ‘Rest of the World’ category, while adding 10 million in the US and EU. Which bodes well for its future opportunities, though the immediate revenue advantages usually are not as significant.

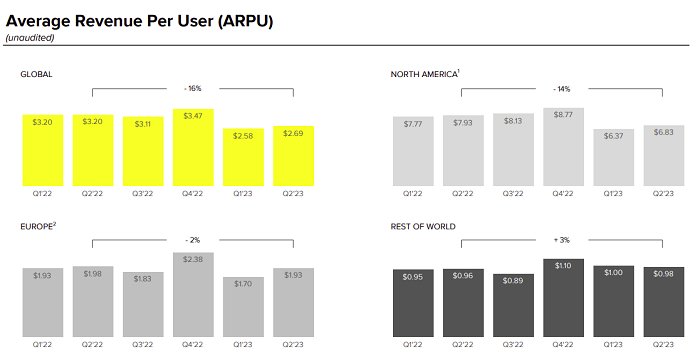

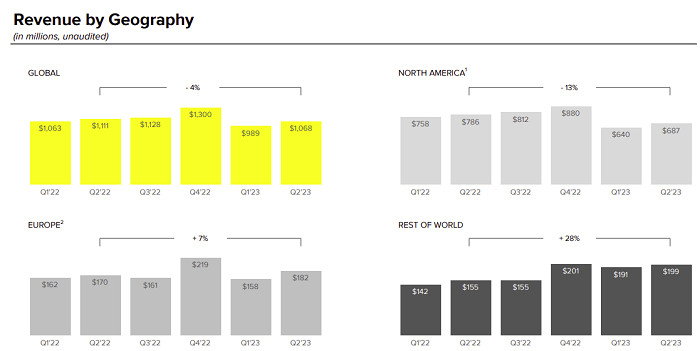

As you’ll be able to see in these charts, Snap’s average revenue per user (ARPU) is much lower in that bottom right category, which implies that while Snap is adding more users, its revenue shouldn’t be growing at equivalent rates, though it’s seeing some recovery in its ad business.

Snap’s overall revenue for Q2 comes in at just over a billion dollars, which is a decrease of 4% year-over-year, but a rise of 8% quarter-over-quarter.

Snap’s still recovering from the impacts of the shifting digital ad market, and the broader economic downturn, however it does note that it has seen improved performance in its ad tools, leading to stronger take-up over time.

“In Q2, we made progress toward improving results for advertisers through machine learning (ML) model updates and infrastructure improvements, recent ways of measuring and optimizing promoting spend, and recent leadership for our go-to-market efforts. We are pleased to see that this progress is starting to translate into improved results with record active advertisers in Q2, up more than 20% year-over-year, and thru improved advertiser retention compared to the identical time period last 12 months.”

So more advertisers are coming to the app, which also bodes well for future success, however it’s not quite translating into big dollars for the corporate straight away, because it continues to construct out its more advanced ad targeting tools, and re-shape its systems in light of evolving privacy and data restriction measures.

Snap was particularly impacted by Apple’s 1OS 14 update, which prompts users as to whether or not they want to share data with an app or not. Given Snap’s deal with user privacy, it’s unsurprising that loads of Snap users opted out of sharing additional information, which has forced Snap to reform its ad targeting process.

And that shift can also be reflected in its outgoings.

Snap’s infrastructure costs jumped almost $50 million in the period, which also relates to AI and AR development, but this may also reflect the continued expense of reworking its ad targeting process, in order to higher align with partner needs.

In terms of more specific elements, Snap says that total time spent watching Spotlight, its TikTok-like short-form video feed, has more than tripled year-over-year, reflecting the continued popularity of the format.

Snap says that Spotlight now reaches more than 400 million users every month, a rise of 51% year-over-year, which shows that while feature replication may look like cheating, and an inexpensive tactic in the sector, there’s clear logic as to why each app looks to steal the most effective ideas from each other.

Snapchat+ has also continued to see strong take-up, recently reaching 4 million paying subscribers.

Snap has seen higher success with Snapchat+ than Twitter has with Twitter Blue (est. 700k sign-ups), despite Twitter making a much greater push on its offering, which reflects each the worth that Snap provides to its dedicated user base, and the utility of the add-ons included in the Snapchat+ package.

Twitter Blue, which has sought to push verification ticks as its key value add, has develop into an increasingly divisive option, with Elon Musk’s fans happily paying up, and chastising those that refuse, as if the very motion is a type of political statement. Snapchat+ has taken a more reserved approach, but the worth that Snap provides has seen many users taking it up anyway, which is why S+ subscriptions are actually almost six times higher than Blue usage.

Snap’s also seen loads of interest in its ‘My AI’ conversational chatbot, which began as a Snapchat+ exclusive, but is now available to all users.

“Since launching My AI, our AI-powered chatbot, over 150 million people have sent over 10 billion messages, which we consider makes My AI amongst the biggest consumer chatbots available today. We are testing My AI monetization with sponsored links that connect our community with partners relevant to their conversation in that moment, while helping brands reach Snapchatters who’ve indicated potential interest in their offerings.”

Interest in generative AI continues to grow, and Snap’s been able to tap into this with this in-app element, which is clearly resonating with no less than some segments of its community. Snap’s also added in visual elements to My AI, so users can generate responses from the tool based on visual cues, while it’s also working on generative visual tools, as an expansion of its AI features.

Snap still has a way to go in getting its ad business back on target, however the signs listed below are generally positive, with more users coming on in developing markets, and more advertisers trying out Snap’s improving ad offerings, which is able to likely lead to more revenue in future.

The concern is the fee of that revenue, and the jump in Snap’s infrastructure spend. That might be a once-off, as a part of general investment in improving the platform, which is able to then facilitate more opportunities. But straight away, in this quarter, that has impacted the general numbers.

Read the total article here