- Google owner Alphabet reported a revenue increase of 15% year-over-year in Q1 to $80.54 billion, in response to an earnings statement. The results topped analyst expectations.

- Total promoting revenues hit $61.66 billion, up 13% YoY. Search and other, Google’s largest segment, grew 14% YoY to $46.16 billion while YouTube continued to assemble momentum, climbing 21% YoY to $8.09 billion. Network revenues declined 1% YoY.

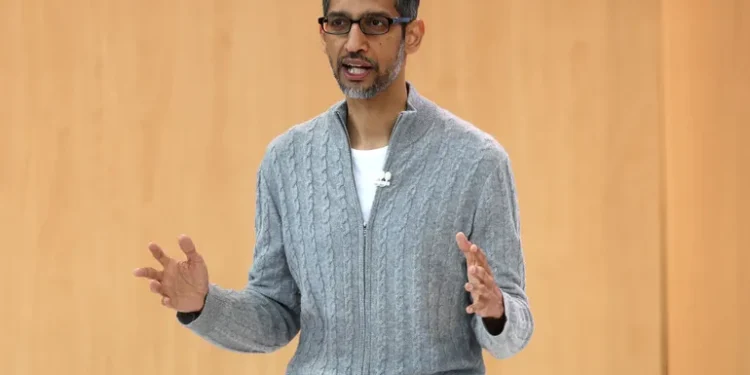

- CEO Sundar Pichai said the corporate is well into its “Gemini era,” referencing the generative artificial intelligence (AI) software that Google has heavily invested in to remain competitive in an emergent sector that would alter the basics of search and beyond.

Google on Thursday joined digital peers in reporting a strong quarter on the promoting front, further affirming that the industry is on the upswing. A lift to look was driven by retail while YouTube drew healthy advertiser demand, bolstered by the TikTok lookalike Shorts and YouTube TV, which has recently piloted latest ad formats like pause ads and secured primetime programming such as NFL Sunday Ticket. Google began running ads in Shorts two years ago and doesn’t yet break out revenue. Executives stated that the monetization rate continues to enhance relative to in-stream viewing.

“YouTube, specifically, seems to have benefitted from live sports investments, ad blocking crackdowns, and enhancements in Shorts monetization, leading to its strongest growth rate in two years,” said Evelyn Mitchell-Wolf, senior analyst at eMarketer, in emailed comments.

Similar to rivals, Google spent much of the discussion trumpeting advances in generative AI, which is positioned to remodel its biggest moneymaker. Google for the past 12 months has been experimenting with a Search Generative Experience (SGE) that’s powered by generative AI and is working to implement more AI features into traditional search.

“We have been through technology shifts before, to the online, to mobile and even to voice technology,” said Pichai on a call discussing the outcomes with investors. “Each shift expanded what people can do with search and led to latest growth. We are seeing an analogous shift happening now with generative AI.”

AI can be playing a much bigger role in fueling Google’s ads business. Gemini, which launched in December as Google’s “most capable” AI model up to now, has recently been integrated into Performance Max campaigns to help with asset generation. Advertisers that used the tool focused on automating images and text were 63% more prone to publish campaigns with “good to excellent ad strength,” Chief Business Officer Philipp Schindler said. Performance Max campaigns, which became widely available to advertisers three years ago, have grow to be a spotlight for Google amid the shift to automation.

The AI mandate has prolonged to marketing partnerships as well. Google is collaborating with WPP to pair its Gemini models with the agency network’s Open operating system. WPP works with top brand clients, including The Coca-Cola Company, which have been quick to embrace generative AI.

But Google’s generative AI strategy has not been without its hitches. Gemini immediately became embroiled in controversy after producing bizarre, ahistorical images. Questions have also been raised over whether products like SGE will affect monetization as the variety of pages users visit when searching are cut down. Executives have stated that the AI search tweaks will proceed to drive traffic to top publishers and merchant sites, though anxiety stays high over the potential revenue impact.

Other headaches for the tech giant include its attempts to phase out third-party cookies in Chrome, a long-in-the-works project that guarantees to reshape the digital promoting ecosystem but has now been delayed 3 times. Investors didn’t ask in regards to the cookie plans.

On the regulatory front, the corporate is facing an antitrust crackdown that would come to a head in Q2. EMarketer’s Mitchell-Wolf noted that the longer term of Google’s core search business is “not assured.”

“A verdict is predicted within the U.S. DOJ’s related antitrust trial in the approaching quarter,” said Mitchell-Wolf. “And the incorporation of AI-generated components into Google’s primary search interface will arguably be the most important change to the search promoting market since its inception.”

Read the total article here