Oil stocks have been one of the few bright spots in the S&P 500 (SPY), during the doom and gloom of the 2022 bear market. However, that party could soon be coming to an end. Below I lay out 3 reasons why oil stocks are no longer a buy, plus reveal how you can still profit from oil stocks as they retreat from their recent highs. Read on for .

Oil stocks have been the one place to make some serious upside over the past year. But even the energy names are looking tired and toppy following a frenzied rally at current levels.

Looks like it is finally time to take some profits and position for a pullback in big oil…

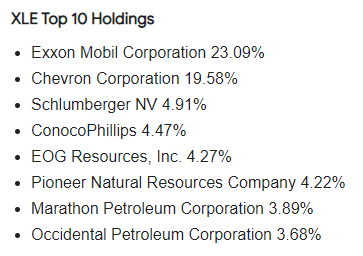

For our discussion, we are going to be using XLE, the Energy Select SPDR ETF, as the proxy for oil stocks. The top two holdings of XLE are the major oil companies ExxonMobil (XOM) and Chevron (CVX). Together these two comprise over 42% of the weighting for the ETF.

Oil Stocks Got Overbought But Are Weakening

The one-year price chart below shows the price action for the XLE. As you can see, XLE got to overbought levels on Wednesday before dropping sharply. 9-day RSI hit 80 then pivoted. MACD neared an extreme before softening. Bollinger Percent B approached 100 then fell.

Shares were trading at a big premium to the 20-day moving average. Previous times these indicators aligned in a similar fashion marked significant intermediate term tops in oil stocks.

I also highlighted the magnitude and length of the prior two rallies (purple lines). Note how they coincide almost identically with the current price action in XLE.

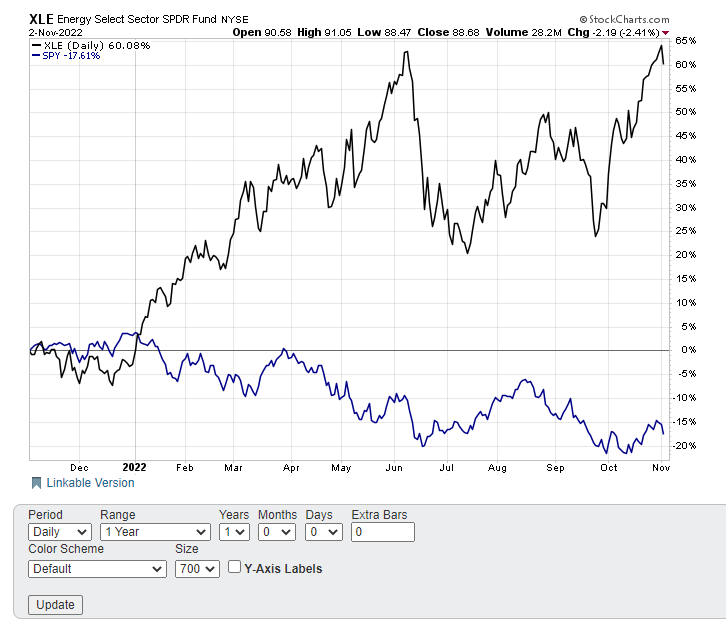

Oil Stocks Getting Extended Versus Stocks Generally

The yearly chart below of oil stocks (XLE) versus the S&P 500 (SPY) shows just how great the outperformance of XLE has gotten to stocks overall. The XLE shows a robust gain of just over 60% in the past 12 months compared to a nearly 17.5% loss for the SPY.

Remember that the major oil stocks such as ExxonMobil and Chevron are in the SPY as well, making the comparative performance even greater once the oil names are stripped out.

Interesting to note that the last time oil stocks hit such heights back in early June led to a significant drop, or mean reversion, in XLE. Look for a similar scenario to unfold with XLE being a relative underperformer to SPY over the coming months.

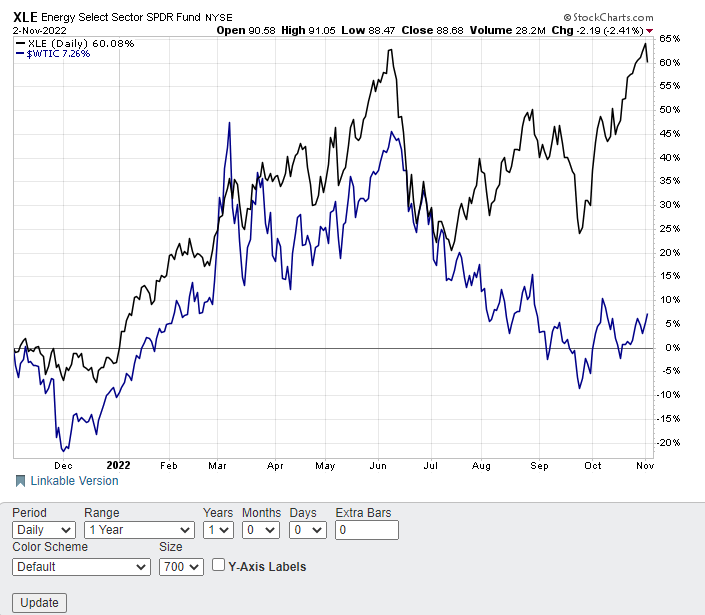

Oil Stocks Getting Way Ahead of Oil Itself

Oil and oil stocks tend to be well-correlated. This certainly makes intuitive sense. If crude climbs, oil stocks should follow and vice-versa.

That certainly was the case for the first half of the year, as seen in the chart below. Both oil and oil stocks made highs in early June as West Texas Intermediate Crude prices ($WTIC) traded well over $120 barrel.

Since then, however, we have seen $WTIC retreat sharply back under $90 barrel while XLE made a fresh new high. This divergence has now gotten to an extreme. XLE is now out-performing $WTIC by over 50% in the past 12 months.

I expect oil stocks to start to drop in sympathy with lower oil prices into year-end.

Traders and investors looking to position to profit from the anticipated convergence in XLE to lower levels can buy puts and put spreads on oil stocks or sell out-of-the money bear call spreads. We have done just that recently with a put diagonal on ExxonMobil (XOM).

What To Do Next?

While the concepts behind options trading are simpler than most people realize, applying those concepts at the right time to consistently make winning trades is no easy task.

The solution is to let me do the hard work for you…by starting a no-obligation 30 day trial to my POWR Options newsletter.

With the quantitative muscle of the POWR Ratings as my starting point, I’ve uncovered some of the best options trades in the tough markets we’ve experienced this year.

That’s because I take advantage of both call and put options trades to generate big gains in ALL market conditions.

In fact, since launching the service in November 2021 I have delivered a market beating +65.44% return for my subscribers.

The good news is that you can become a subscriber today for just $1.

During your $1 trial you’ll get full access to the current portfolio, my weekly market insights and every trade alert by text & email.

Plus, I’ll be adding the next 2 exciting options trades (1 call and 1 put) when the market opens this Monday morning, so start your trial today so you don’t miss out!

About POWR Options & $1 Trial >>

Here’s to good trading!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares rose $4.99 (+1.34%) in premarket trading Friday. Year-to-date, SPY has declined -20.33%, versus a % rise in the benchmark S&P 500 index during the same period.

Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

More…

The post 3 Big Reasons Why Oil Stocks Are No Longer a Buy appeared first on StockNews.com

Read the full article here