Back in 2022, Sprout Social released a report, titled “The State of Social Media Marketing in 2022,” surveyed over 1,200 and located that 68% of consumers usually tend to trust a financial brand that’s lively on social media.

What’s more, the 2023 Fintech Consumer Report by Mintel also found that 75% of consumers say that social media has influenced their financial decisions. These results are enough to start thinking about investing in social media activities for fintech firms.

Let’s take a deep have a look at best social media practices for fintech firms.

Don’t Talk about Money but People & Feelings: Humanizing the Brand

Yes, we’re indeed referring to fintech firms! The art of storytelling and sharing posts that deeply resonate with web users is a well-established technique for this sector as well. Fintech firms like CashApp, ANNAMoney, Zopa, and so forth effectively connect with their audiences by utilizing memes, TikTok videos, and relatable first-person narratives.

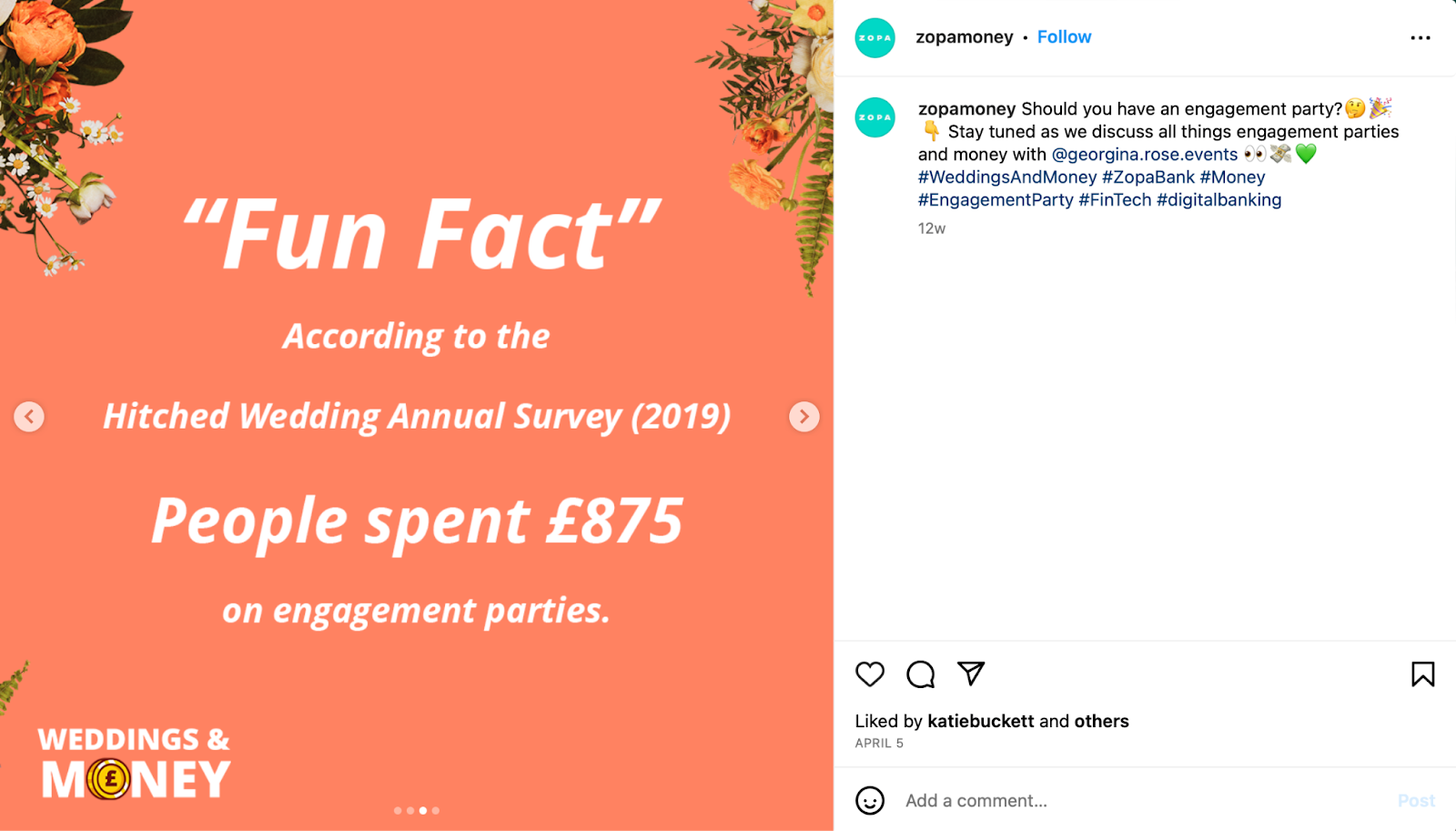

For instance, Zopa, the firm connecting individuals seeking to borrow money with investors, often takes its Instagram account to share posts focussing on the needs of individuals & every day challenges about finance.

The firm also gives advice on budget management through events like “Money Mindfulness Challenge.”

Another financial company Cleo with the motto “your AI companion for financial well-being,” focuses on the problems related to mental health and talks about investing in wellness.

As for ANNAMoney encourages their audience to begin their very own business:

So, it is feasible to say that they’ve mastered engaging their audience through these mediums and establishing strong connections.

Many fintech firms actively engage in celebrating special days & occasions on social media as a part of their marketing efforts, aiming to attach with users on a deeper emotional level. These firms embrace various significant days and events, leveraging them as opportunities to foster a way of community and resonate with their audience. By participating in these celebrations, fintech firms display their understanding of user sentiments and their commitment to constructing strong relationships through social media channels.

Stash, the fintech company, takes its social media channels with the celebration of special occasions. For Mother’s Day, the marketing team of the corporate, shared videos that focus on the theme of monetary freedom. Through these videos, Stash aimed to spotlight the importance of empowering moms – and girls as well – to realize financial independence.

What’s more, Affirm, a widely known fintech company specializing in point-of-sale lending, celebrates special days on social media as a part of their marketing and engagement strategy.

Another example:

Social media contests and giveaways are an amazing solution to generate excitement and engagement for fintech brands. These contests can offer a wide range of attractive prizes, equivalent to free products, services, and even money. By doing so, brands can create a vibrant and interesting atmosphere that encourages lively participation from their audience.

The investment app that enables users to take a position in stocks, ETFs, and fractional shares, Stash is an amazing example of utilizing contests and giveaways to boost brand awareness. By running such campaigns, Stash effectively exposes its brand to a broader audience, ultimately contributing to increased brand recognition and visibility.

Similarly, Cash App offers in-game challenges on weekly basis to attach its audience:

Share Up-to-Date Content

In addition to sharing the most recent news, trends, and insights, financial institutions – a.k.a fintech firms – should keep their social media profiles lively and interesting on a regular basis. This approach leads them to remain ahead of the competitors while encouraging their followers to interact on social media channels.

As a part of its effective social media strategy, ANNAMoney, a fintech business, shares posts that humorously tackle the present hot topics, equivalent to AI:

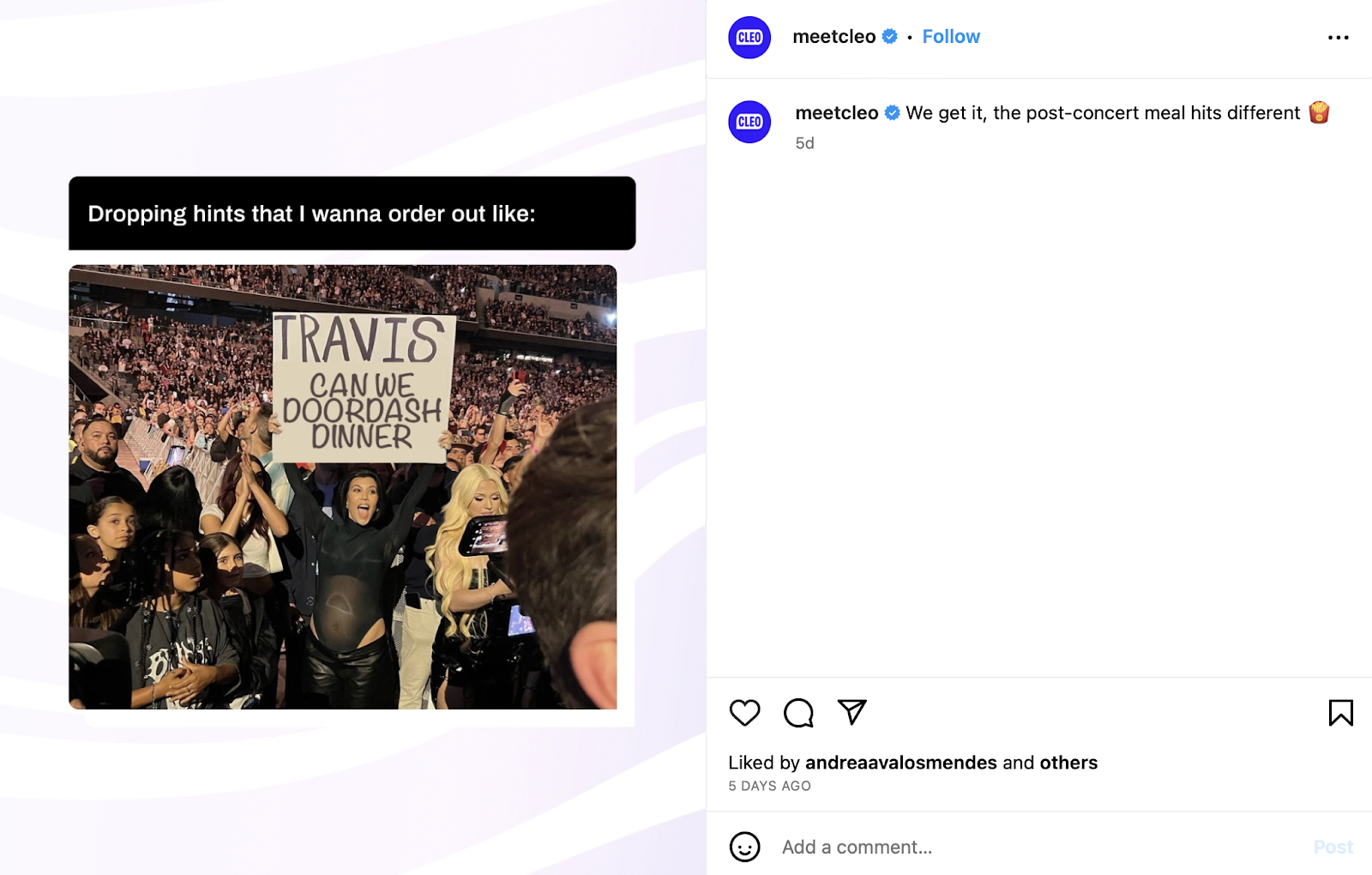

Some of the fintech firms who’re superb at social media management don’t forget to check with viral occasions. For instance, Cleo took to Instagram, using a photograph of Kourtney Kardashian holding an indication during Travis’ concert as a creative reference.

Collaborate with Influencers & Public Figures

Like in other industries, collaborating with influencers and public figures in finance on social media is a game-changer for your brand. This strategy permits you to reach recent horizons while elevating your brand’s visibility. As known, finance promoting faces unique challenges that could make trust-building difficult – like complexity and skepticism.

At this point, it’s vital to collaborate with respected influencers and public figures to boost your brand’s credibility. This credibility boost can result in higher conversion rates as potential customers feel more comfortable engaging together with your brand. More than being respected? It’s a superb call to team up with a figure that caters to your brand.

As an amazing example, there was a collaboration between the well-known rapper Drake and a fintech brand – the mobile payment app – Cash App. Since that date, Drake has been sharing videos & static posts on his social media channels promoting Cash App’s services, products, giveaways, and more.

Embrace an Engaging Voice According to Target Audience

In the world of fintech social media, it’s crucial to hit the nail on the top with an interesting voice that speaks the language of your audience. In case there’s a stereotype that the fintech industry is a straight-laced and monotonous world, it is crucial for a novel social media presence to indicate your audience that you would be able to have a whale of a time. Of course, while doing that embracing knowledgeable tone of voice just isn’t to be neglected: Creating balance is the important thing.

Cleo, mentioned above because of its outstanding social media approach, sets an example for a balanced tone. In a number of the posts, the firm embraces a hilarious & dynamic tone of voice to succeed in its goal group.

In others – containing educational content, news, trends, or updates – Cleo uses knowledgeable tone & asks questions on related fields of the economy to have interaction with the audience. And evidently works well (it has 123K followers just on Instagram!)

Achieving such a major impact on the audience through social media can transcend the reach of internal marketing efforts alone. In such cases, it might be smart to contemplate partnering with among the best fintech marketing firms. Collaborating with a good agency can provide the expertise, resources, and industry knowledge needed to raise your social media presence to recent heights.

Build Trust Among Users

Despite the challenges related to the complex nature of the finance sector, robust marketing strategies (after all with outstanding social media management) allow brands to construct trust amongst its users.

Establishing trust for your fintech company on social media requires implementing just a few key strategies related to digital marketing.

Foremost, prioritize transparency by sharing details about fees, security measures, and data usage without causing confusion. That sort of approach shows your commitment to credibility. Second, be very aware of inquiries, feedback and wishes of shoppers, and supply them with honest answers. What’s more, sharing informative content – blog posts and videos talking about your services and products – helps position your organization as a thought leader within the fintech sector.

And, after all, paid promoting campaigns, testimonials, and case studies are great players in the sport of trust constructing.

Check, Please!

In the fast-paced world of fintech, a wealthy social media presence is paramount to remain ahead of the sport. Yet, the sector’s intricacies demand a specialized touch, making it critical to team up with social media agencies.

It’s absolutely true for digital marketing activities for fintech startups as well. Marketing agencies for finance firms provide a strategic approach & social media data it’s good to navigate the unique challenges and competition of the fintech sector. With their deep understanding of the fintech landscape and their progressive marketing strategies, these agencies may help your enterprise achieve unparalleled growth and heightened visibility within the digital marketing realm. Just give it some thought. 🙂

Read the complete article here