Consumer confidence has been increasingly volatile for the reason that presidential election. The latest administration’s higher tariffs, lower government spending and radical tax changes have unnerved many individuals. The University of Michigan’s Consumer Sentiment Index has fallen from 74 in December to 50.8 in April. After five months of declines, The Conference Board Consumer Confidence Survey surged in May, but stays below where it was in 2021.

Here’s what consumers and marketers are already doing to address the economic uncertainty.

Consumers

Price, not brand, is driving decisions: 76% of U.S. consumers are either “very likely” (36%) or “somewhat likely” (40%) to alter brands for a greater price or value, in line with a survey by performance marketing firm Wunderkind. That’s much more pronounced amongst younger consumers, with 42% of Millennials and 37% of Gen Z within the “very likely” category.

“The constant and unpredictable reversals and adjustments of tariffs lack consistent context, meaning consumers don’t know the best way to properly plan for their immediate budgetary future, much less a long-term one,” said Greg Zakowicz, senior ecommerce expert at marketing automation company Omnisend.

There is not any loyalty: Nearly 90% of consumers will change brands in the event that they see a major price hike, in line with Wunderkind’s 2025 May Marketers/Consumer Tariffs Impact report. What’s significant? Two-thirds will jump to a brand new brand for a 20% or less price difference, with most saying the tipping point is 11%-20%. FYI: While latest tariffs vary by nation, the present average of all tariff increases is 17.8%, in line with the Yale Budget Lab. That was calculated before President Trump threatened the EU with a 50% tariff last week.

Dig deeper: In a world of tariffs and turmoil, marketing’s insight is a superpower

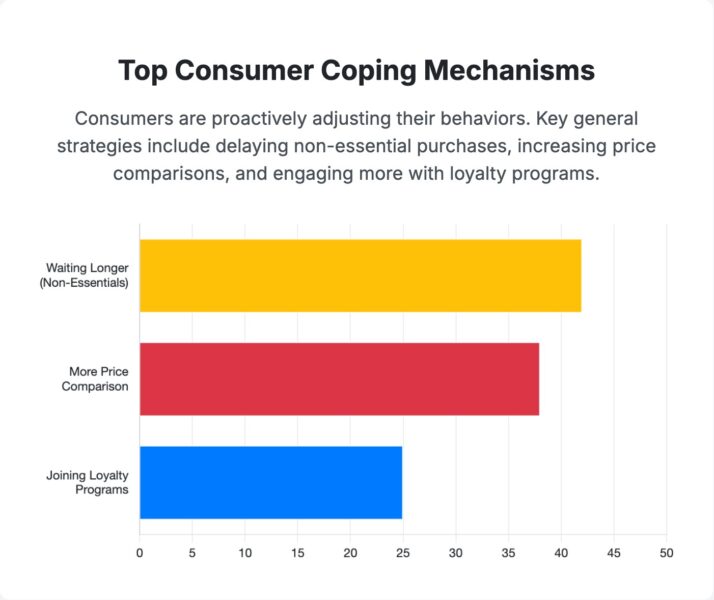

Significant buying changes underway: Consumers are showing more discipline in discretionary spending.

- 42% are waiting longer before buying non-essential items.

- In the grocery and essentials category, 40% are switching to cheaper or store/private-label brands, and 33% are stockpiling when prices are lower.

- For apparel, 43% are waiting for sales or promotions. Switching to cheaper brands (33%) and shopping thrift or second-hand (29%) are also gaining traction.

- 47% are delaying the acquisition of high-ticket items (over $200) until essential, 44% are waiting for sales or promotions and 30% are switching to cheaper brands.

Here for the long run: 36% of consumers expect to feel the economic squeeze “through the tip of 2025 or longer.” That’s greater than double some other answer. Older shoppers are essentially the most pessimistic, with 49% of Boomers expecting to be affected for at the least the remaining of the yr. Only 17% imagine tariffs won’t significantly disrupt their shopping behavior. For marketers, this underscores the necessity for strategies built for endurance.

Businesses are as pessimistic as consumers. A survey of SMB merchants by Omnisend found:

- 36.8% anticipate a negative business impact from tariffs.

- 13.2% expect it to be “significant.”

- 64% expect consumers will spend less over the subsequent 12 months.

Marketers

Marketers are adjusting prices and prioritizing owned channels and data.

Don’t say “tariff”: Companies dislike raising prices for reasons beyond their control. If they do, the most effective practice in marketing is to be transparent and honest about why it is occurring. However, using the word tariff can draw the wrath of President Trump, as seen with Amazon, Walmart, Mattel and others.

The Conference Board even issued an advisory about using the “T” word.

“Avoid breaking out tariff-induced costs, which could possibly be interpreted by some as a political statement, to take care of neutrality. Instead, explain that input, import, or sourcing costs have risen without mentioning the term ‘tariffs’ directly, which could be too politically charged.”

It’s value noting that 81% of U.S. consumers report high awareness of reports about tariffs, in line with the Wunderkind survey. So, they know why prices are rising, even for those who don’t tell them.

Dig deeper: Winning customer loyalty starts with straight discuss tariffs

Prices are indeed going up: 57% of marketers say they are selectively increasing prices in tariff-impacted categories, and 72% of brands are increasing prices as a consequence of the tariffs, in line with Wunderkind.

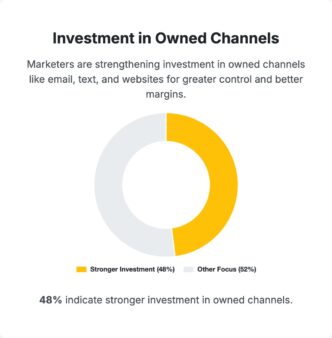

Turning to owned channels: Aside from pricing, marketers are making some big strategic changes. The most typical move, 48% of respondents say, is focusing more on owned channels like email, text and web sites. That points to a transparent shift toward options that supply more control, stronger margins, and a direct line to the shopper.

“Brands may have to re-evaluate their pricing strategies to account for additional headwinds, reminiscent of tariff costs, and really understand their shifting customer behaviors,” said Cary Lawrence, CEO of consumer analytics company Decile. “Doubling down on personalization to mitigate price or discount sensitivities is not any longer optional — it’s a requirement.”

That explains why 48% of marketers said first-party data growth is their top opportunity for 2025. That indicates a foundational shift towards leveraging owned data for personalization, segmentation, and retention.

Additionally, performance-based marketing solutions are the highest priority for martech investment (56%), showing a requirement for technologies that deliver guaranteed, measurable outcomes. Marketers are also testing latest product pricing and value bundles (45%) and increasing promotional offers and discounts (40%) as a part of their response.

Dig deeper: 3 ways to show tariff turmoil into marketing gold

Sad holidays ahead? While consumers consider the immediate price impact, marketers are planning for the impact on holiday shopping. More than two-thirds (68%) say they are modifying holiday strategies. They are shifting from reactive to proactive planning, testing messaging and offers earlier within the yr to refine execution ahead of peak holiday demand.

Retailers will likely see essentially the most acute effects as production costs increase dramatically for overseas production. In addition to raising prices, retailers will cut spending to retain margins, and as you recognize, marketing is a favourite place to chop. Social, search and retail media because the channels probably to see a drop in ad spend, in line with a report by Advertiser Perceptions. That is because they over-index on performance advertisers and brands, particularly those based in China.

“Historically, brand promoting has struggled in tough economic times, while performance has been more resilient,” the report said. “This will probably be the case this time, however the brands with the most important performance budgets (retailers) will probably be impacted most severely overall.”

On the opposite hand, corporations that invest more in upper-funnel ads could be higher positioned to weather the impact.

Going into 2025, marketers expected their budgets to remain the identical, and advertisers saw solid growth for media budgets. Now, as tariffs are raised, then lowered, then raised not-quite-as-high, nobody can say what’s next. What we do know is that far fewer cargo ships are arriving in U.S. ports and consumers are pulling of their wings. Those are likely the most effective economic indicators to plan around.

The post How tariffs are reshaping long-term strategies for brands and buyers appeared first on MarTech.

Read the total article here